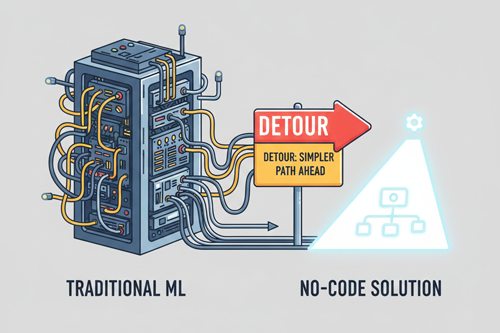

The Low-Code Advantage: Speed and Cost Control

For small and medium-sized enterprises (SMEs), LCNC platforms serve as a crucial cost control measure.

Accelerated Time-to-Value:

Traditional model development can take weeks. Using LCNC platforms, tasks like audience analysis can be compressed, cutting a six-week timeline down to approximately 10 minutes. This speed dramatically increases your ROI.

Operational Expense, Not Capital Investment: Most LCNC solutions are offered as Software-as-a-Service (SaaS), such as Akkio or Gini Machine. This allows you to manage AI development as a predictable operational expense rather than a massive, upfront capital investment.

Bypass the Skills Gap:

These tools use visual drag-and-drop interfaces to automate everything from data cleansing to model selection, meaning you don’t need highly compensated Machine Learning experts or programmers to get started.

Actionable Steps to Get Started:

Select an LCNC Tool: Look for platforms that specialize in predictive analytics for business use cases. Many offer free trials or accessible starting tiers.

Prepare Historical Data: The model needs historical customer data that clearly indicates which customers left (Attrition Flag) and which stayed (Existing Customer).

Focus on Predictors: Upload the data points you already collect (like transaction history, account balance, and months on book). The AI will use these to find complex, non-linear patterns that predict churn.

What exact data points should you be feeding into your No-Code AI model? Find out in our third post: “Beyond Demographics: 3 Simple Data Points That Predict Attrition in Banking and Finance.”