Customer churn—the rate at which clients discontinue their relationship with your business—is a silent killer of revenue. For US businesses overall, avoidable customer switching costs nearly $140 billion annually. For financial services, retaining existing customers is far cheaper and more stable than acquiring new ones. Before you invest a single dollar in retention, you need to measure the problem accurately.

Step 1: Calculate the Basic Customer Churn Rate (The Volume)

This is the most common and easiest metric, giving you the raw volume of lost customers.

• Example: If you had 1,000 customers at the start of the quarter and lost 50 by the end, your Churn Rate is 5%.

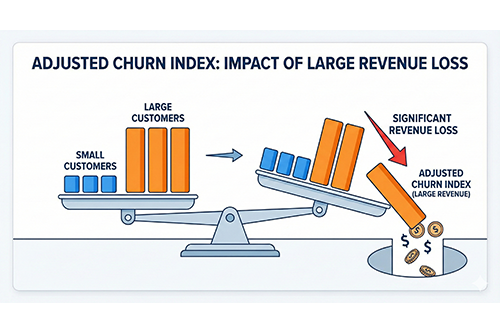

While this provides a simple health check, it treats every customer equally losing a high-net-worth client counts the same as losing a small-account holder. This brings us to the more strategic metric.

Step 2: Track Revenue Churn (The Impact)

A strategic financial approach prioritizes the loss of high-value revenue streams over sheer volume. Tracking Revenue Churn Rate ensures you don’t get blindsided by deceptive growth numbers, where an influx of small accounts hides the loss of major contracts.

A more sophisticated, but necessary, step for strategic planning is defining your Adjusted Customer Churn Index. This metric weights each lost customer, providing a nuanced understanding of the financial impact and strategic importance of attrition. Focus your retention efforts on protecting your critical revenue streams—not just every customer.

Actionable Advice for Lean Teams:

• Go Beyond the Number: Don’t just calculate churn; segment it. Break your churn rate down by product (e.g., credit card services vs. wealth management) or customer value tier (high-value, mid-tier, low-touch). This will immediately tell you where the worst leaks are.

• Focus on the Financials: Once you have your basic volume, commit to tracking the Revenue Churn Rate in your core product lines. This is the metric that justifies all future retention spending.

• Formula: $$ \text{Customer Churn Rate} = \frac{\text{Number of Customers Lost During Period}}{\text{Total Customers at the Start of the Period}} \times 100 $$

Now that you know how much churn costs you, read our next post on “The Blueprint for Low-Cost AI: Predicting Churn Without Hiring a Data Scientist” to discover budget-friendly tools that predict who is about to leave.