The Predictive Edge: Using Behavioral Data as an Early Warning System for Financial Churn

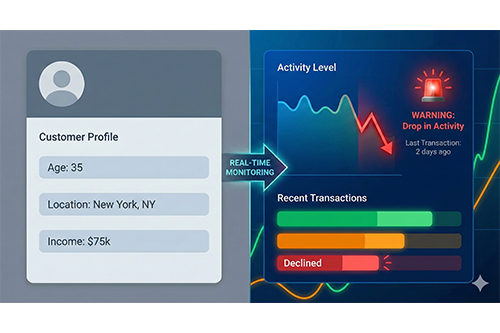

To accurately predict attrition, you must shift your focus to behavioral segmentation—grouping customers by how they use your product. These are the leading indicators that signal dissatisfaction months before a customer formally closes an account.

The Three Essential Data Points for Prediction:

Recency, Frequency, Monetary Value (RFM) Analysis: This foundational principle segments customers based on their transactional activity. You likely already collect this data.

Recency:

When was the last transaction?

Frequency:

How often did they transact (Total Trans Count) in the last year?

Monetary Value:

How much did they spend or utilize (Total Trans Amt)? The AI uses these scores to flag customers moving from “Loyal” to “At-Risk”.

Changes in Usage (The High-Confidence Signal):

A sudden, measurable reduction in product usage is one of the most powerful precursors to churn.

Look for changes in transaction count or amount between quarters (e.g., Trans_Count_Chng Q4 Q1).

A significant drop-off or a rise in inactivity (Months Inactive 12 Mon) indicates potential financial strain or dissatisfaction, serving as a critical early warning signal.

Direct Customer Feedback (The Voice of Risk): Don’t wait for the AI model to tell you someone is unhappy—ask them directly.

NPS Scores:

A low Net Promoter Score (NPS) is a direct, high-confidence indicator of low loyalty and future churn.

Support Tickets:

An influx of customer support tickets or a high drop-off rate is a direct indicator of low satisfaction.

Actionable Advice for Lean Teams:

Data Aggregation: Review your data over a 6- to 12-month period to establish a reliable baseline and identify meaningful trends.

Prioritize Engagement Metrics: When feeding data into your No-Code AI model, prioritize features like Total Trans Count and Avg Utilization Ratio over static demographic details.

Internal Link:

Once your AI flags a customer, you need a plan. Read our final post: “Human-in-the-Loop: 3 Budget-Friendly Tactics to Win Back At-Risk Customers.”